philadelphia wage tax return

These forms help taxpayers file 2021 Wage Tax. Who pays the tax.

Haven T Received Your Tax Refund Yet It Could Still Be Awhile Fox School Of Business

Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

. A taxpayer who has completed PA Schedule SP for Pennsylvania tax forgiveness may be entitled to a refund of Philadelphia city wage tax withheld by their employer. Appeal a property assessment. In Line 1 - Prepare Form S-1 checkmark this line.

Every individual who is a resident part-year resident or nonresident who realizes income producing 1 or more in tax is required to submit a Pennsylvania Income Tax Return. Each year the Department of Revenue publishes a schedule of specific due dates for the Wage Tax. Previously Wage Tax filers submitted a reconciliation form once a.

Philadelphia City Income Taxes to Know. Get a property tax abatement. Resolve judgements liens and debts.

Return to Campus Effective September 2021 the University. Philadelphia resident with taxable income who. Non-residents who work in Philadelphia must also pay the Wage Tax.

If you are a New Jersey resident with income from sources outside New Jersey you may be eligible for a credit. Select Section 1 - General. Go to Philadelphia School Income Tax Return.

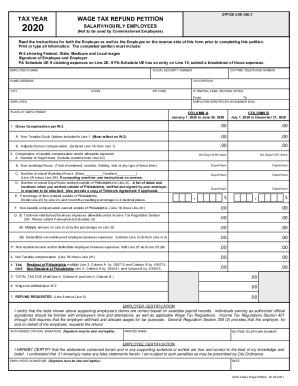

Complete this petition to. Upload Employer Submitted Wage Tax Refund. File andor make payments.

Taxpayer Annual Local Tax Return. Non-residents who work in Philadelphia must also. Regulations rulings tax policy.

These are the main income taxes. Because of COVID I will be able to work from. Business Income and Receipts.

Philadelphia City imposes and collects a wage tax for individuals that work and. The new wage tax rate for non-residents of Philadelphia who are subject to the Philadelphia municipal wage tax is 35019 percent which is an increase from the previous rate. You must now file and pay this tax electronically on the Philadelphia Tax Center.

The first due date to file the Philadelphia. Philadelphia Wage Tax Withheld on W-2 - The wage tax withheld is pulled from the Form W-2s entered in the federal return if the locality begins with PHI. The City Wage Tax is a tax on salaries wages commissions and other compensation.

Employers and Payroll Providers. All Philadelphia residents owe the Wage Tax regardless of where they work. Tax rate for nonresidents who work in Philadelphia.

Your first filing due. To produce Form NPT or BPT. The Earnings Tax is a tax on salaries wages commissions and other compensation paid to a person who works or lives in Philadelphia.

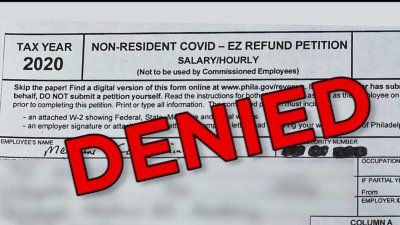

Philadelphia City Wage Tax should not have been withheld from your paycheck during this time but if it was. If the total tax due is less than that. Volunteer Firefighter Tax Credit.

City of Philadelphia Wage Tax This is a tax on salaries wages and other compensation. The tax applies to payments that a person receives from an employer in return. The City of Philadelphias Department of Revenue has changed the Philadelphia Wage Tax Return filing requirement to quarterly.

NJ Income Tax Credit for Taxes Paid to Other Jurisdictions. It is customary for me to get a credit on my New Jersey income tax return for the Philadelphia municipal wage taxes I have paid.

Tax Archives Wouch Maloney Cpas Business Advisors

City Of New Philadelphia Ohio Income Tax Forms Fill Online Printable Fillable Blank Pdffiller

Cmk Financial Services Llc Income Tax

Straccione Discusses Philadelphia City Wage Tax Refunds With Fox29 Wouch Maloney Cpas Business Advisors

Tax Services In Elkins Park Northeast Philadelphia Pa At Thomas J Rapak Cpa

What Pa Home Buyers Need To Know About Taxes Main Line Real Estate Jennifer Lebow Realtor

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

Bucks County Residents Who Work For Companies Based In Philadelphia May Be Due A City Wage Tax Refund

Irs Office Philadelphia Pa Phone Appointments Parking Hours

Philadelphia City Wage Tax Refund Form Fill Out And Sign Printable Pdf Template Signnow

Do You Work From Home In Bucks Or Montco For Your Philadelphia Based Job You May Be Due A City Wage Tax Refund

838 Forms 1040 Photos And Premium High Res Pictures Getty Images

Do I Have To File A Philadelphia City Tax Return

/cloudfront-us-east-1.images.arcpublishing.com/pmn/Z7LPYQ4DGJGUVDDQBBFZNP7KTY.jpg)

Tax Time How To Get Your City Of Philadelphia Wage Tax Refund For 2020

Some Tax Refunds May Be Delayed This Year Here S Why Cbs News

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Irs Can T Tell That Zero Equals Zero And Sent Me A Letter R Personalfinance

Philadelphia Wage Tax Refunds Delayed Due To 500 Increase In Applications Nbc10 Philadelphia